This is a linkpost for https://rethinkpriorities.org/research-area/investments-into-insect-farming/

Short summary

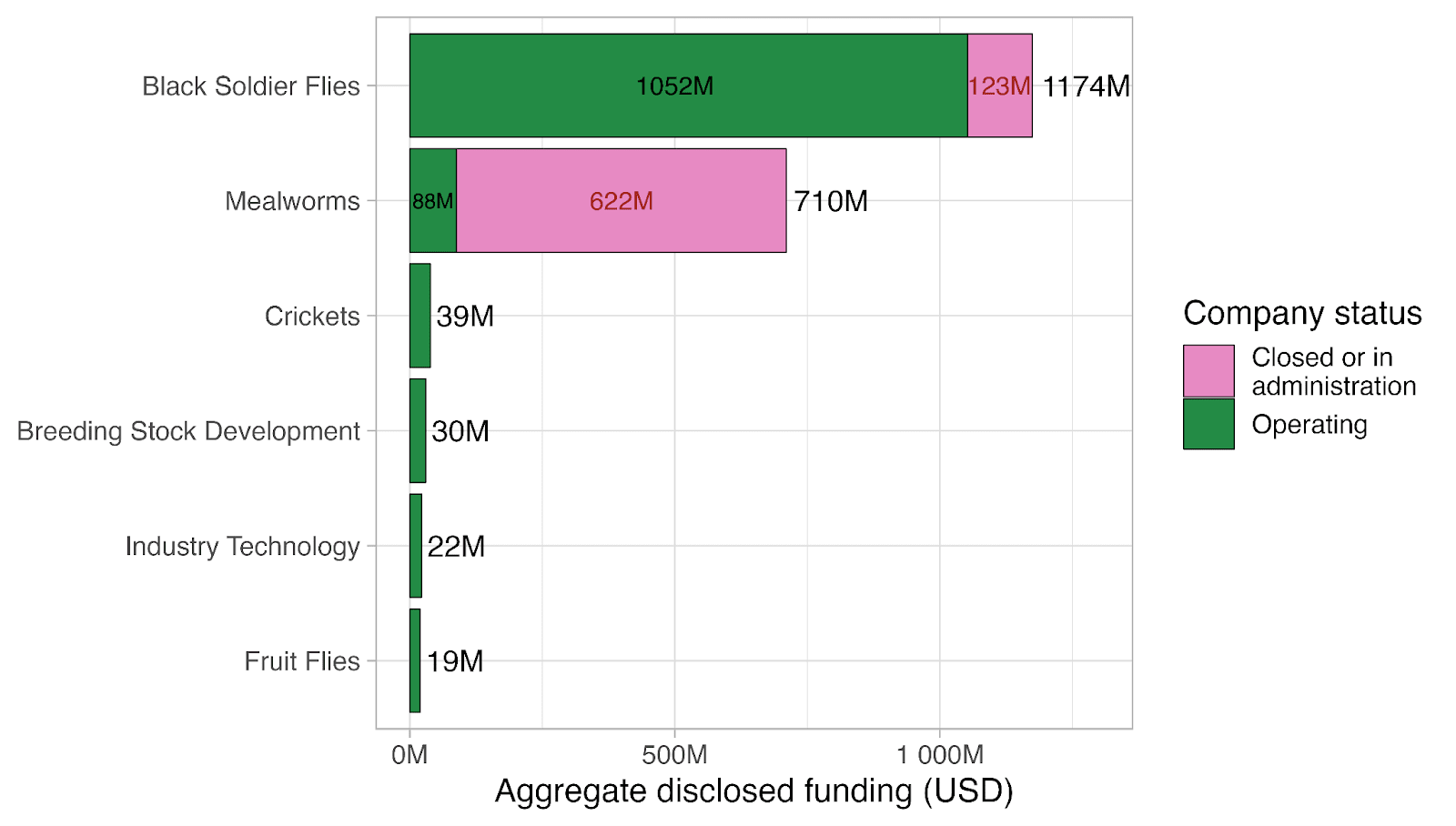

- Publicly disclosed investments of around $2B have flowed into insect farming businesses to date, mostly producers of black soldier fly larvae (59%) and mealworms (36%). But major players accounting for 37% of investment have either failed or are known to be struggling.

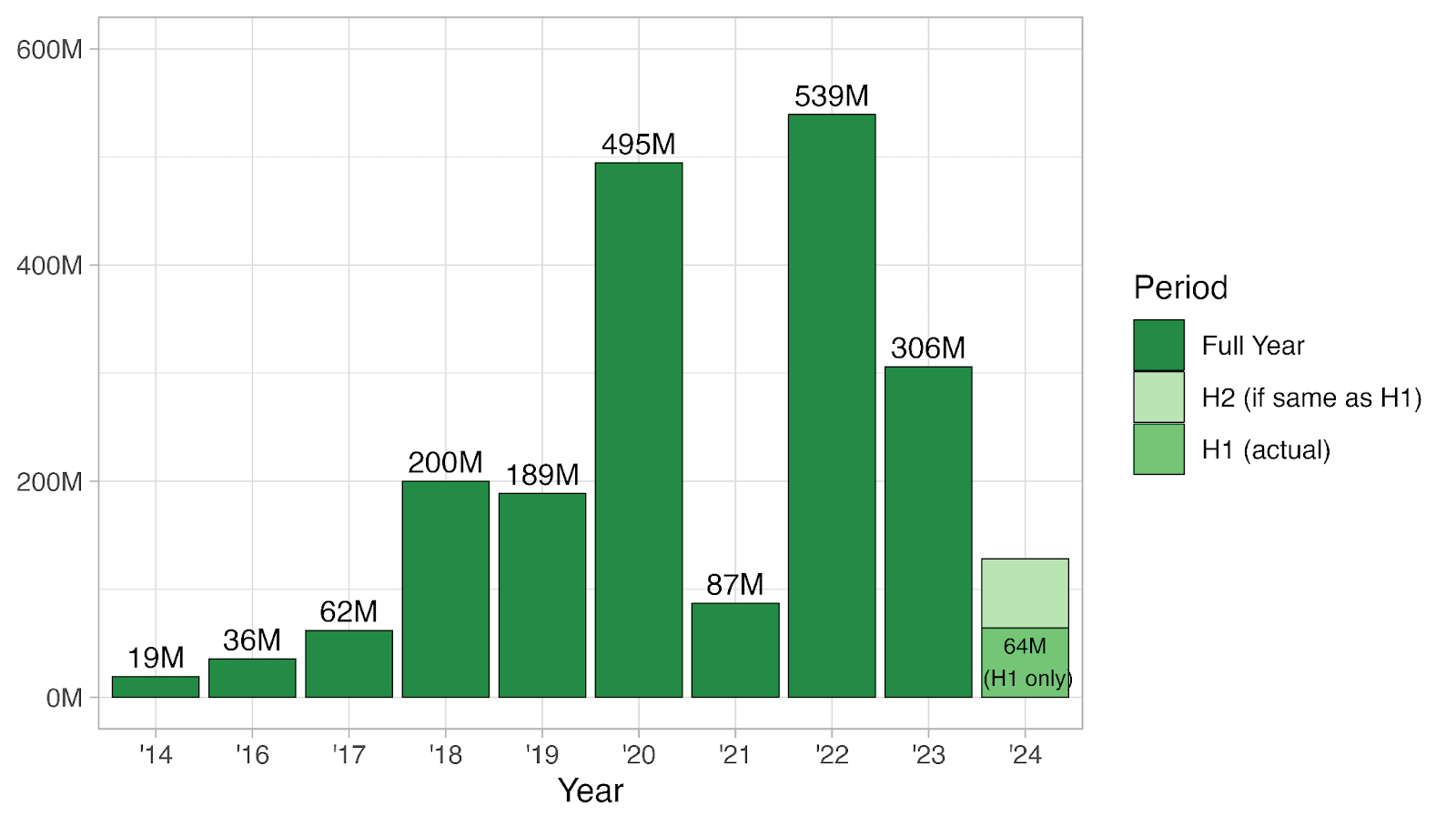

- Annual investment flows into insect farming were growing rapidly prior to 2021, but this trend appears to have stopped. Investor sentiment is low and has been rocked by recent failures.

- I built a simple model to estimate what paths for future investment flows might mean for future production capacity of dried black soldier fly and mealworm larvae.

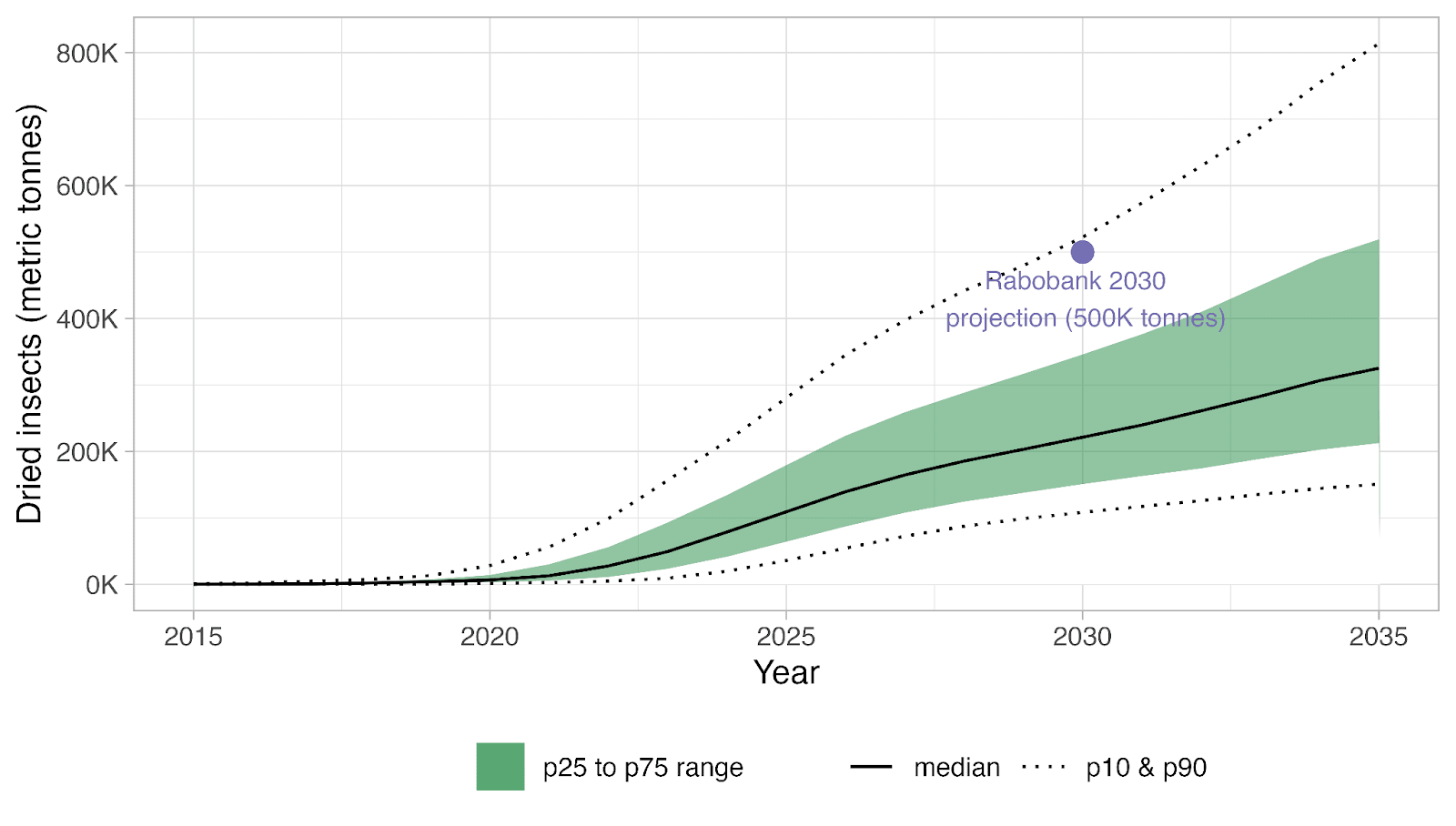

- The median model projection points to production capacity of 221K metric tonnes of dried insects by 2030, less than half of that predicted in an influential 2021 Rabobank report.

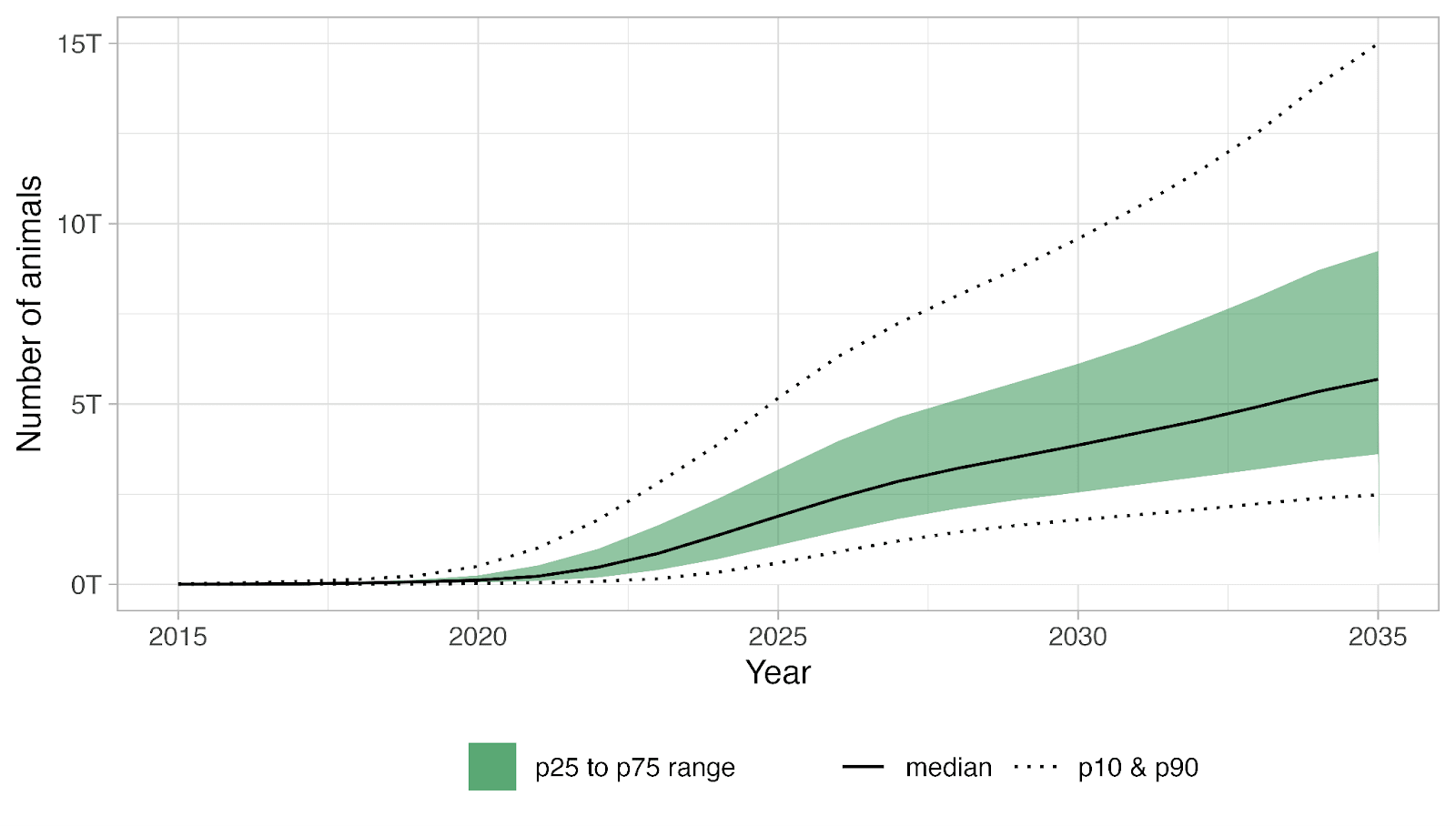

- Despite a more modest production outlook, the median scenario is still consistent with a very large number of insect larvae being farmed (293B at any time) and killed (3.9T annually) in 2030.

- There are many limitations and caveats with the model and its projections, which should be read before citing the numbers or making decisions based on them.

Longer summary

- This report analyzes recent trends in investment into insect farming and estimates the production capacity for black soldier fly and mealworm larvae based on paths for future investment flows.

- Cumulative publicly disclosed investments into insect farming totalled just under $2B until end June 2024. However, at least $745M (or 36%) of this investment has been made into companies that have either stopped operating or entered a court-supervised restructuring process.

- A majority of investments have been made into firms farming black soldier fly larvae (59%) or mealworms (36%). However if we exclude large firms that have stopped operating or are struggling, the vast majority of investment (84%) is into businesses farming black soldier fly larvae.

- Prior to 2021, annual investment flows into insect farming were growing rapidly. This trend appears to have now stopped, and there are signs annual investment flows may have flattened off or may even be falling.

- It is difficult to know how much of this is due to the broader investment environment, or sector-specific concerns about insect farming, though there is evidence that investor sentiment is low and has been negatively affected by the failure of major players.

- To help understand the implications of changes in the investment landscape, I built a simple model that projects future production capacity of the black soldier fly and mealworm farming sectors. The model takes a Monte Carlo simulation approach, and is based on possible future paths for investment flows and assumptions about how quickly and efficiently the industry can turn investment into production capacity.

- The median model projection points to industry production capacity of around 221K tonnes of dried insects by 2030. This is just under half of the production capacity anticipated by an influential 2021 Rabobank report. The Rabobank report projection was in turn below many other market forecasts.

- Although the median model projection potentially implies a lower future production capacity, it still points to a very large number of insects being farmed and harvested. The median model projection is consistent with 3.9T black soldier fly larvae and mealworms being harvested in 2030, and around 293B larvae being farmed at any time.

- Uncertainty around the estimates is high, and the model has many limitations. I highly recommend reading the caveats and limitations section prior to using or taking decisions based on the figures based on this report.

Selected charts from the report

Annual investment flows into insect farming (by value, USD)

Cumulative investment into insect farming by species, activity, and company status

Projected production capacity of the BSF and mealworm farming sectors out to 2035

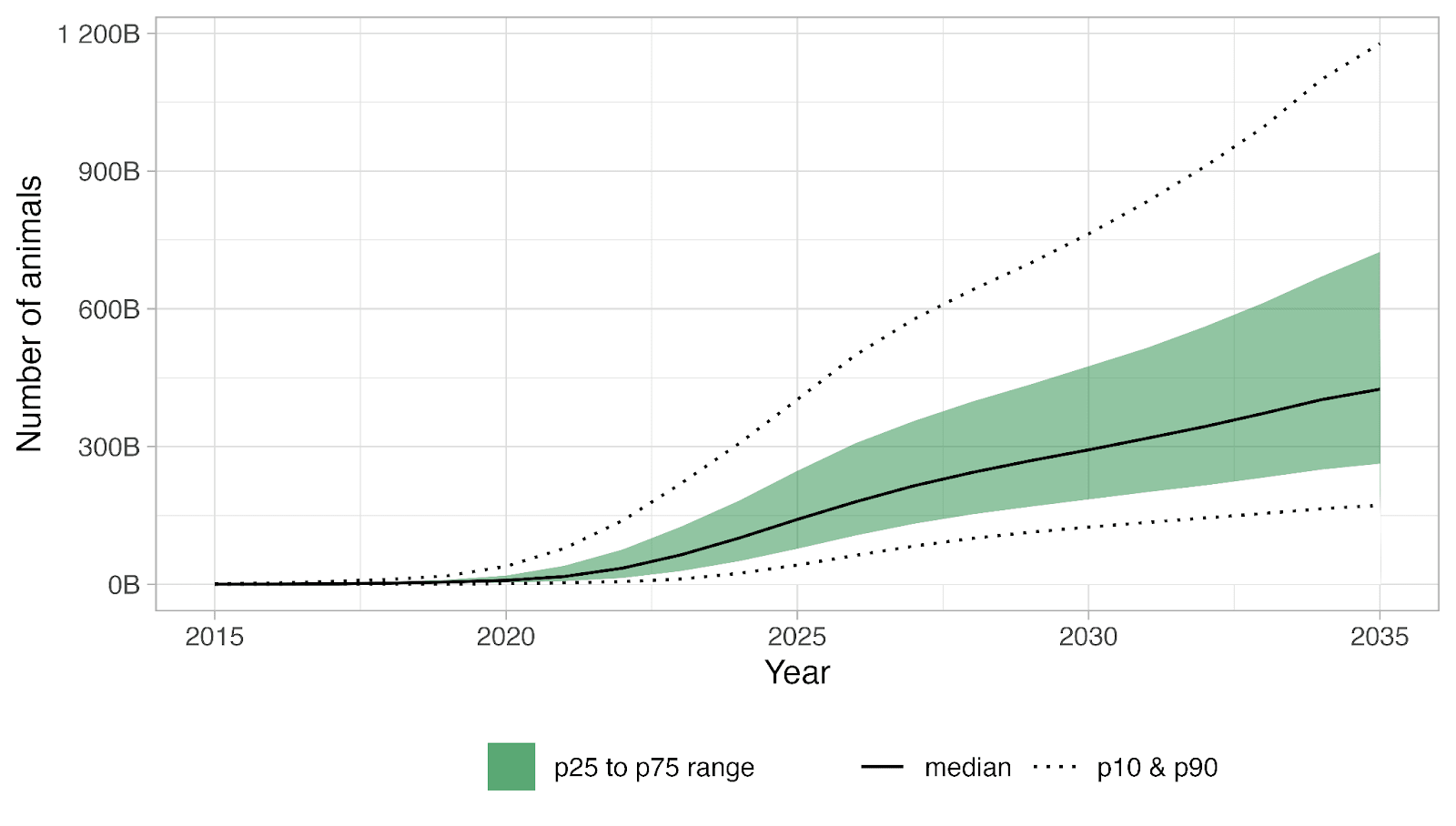

Projected number of BSFL and mealworms harvested annually

Projected number of BSFL and mealworms alive at any time

Executive summary: Investment in insect farming has stalled since 2021 with many major players struggling, suggesting future production capacity will likely be much lower than previous forecasts, though still involving billions of farmed insects.

Key points:

This comment was auto-generated by the EA Forum Team. Feel free to point out issues with this summary by replying to the comment, and contact us if you have feedback.

Very interesting, thanks!