Robin

Bio

Robin studies climate change.

Posts 2

Comments30

Do current person-affecting ethicists become longtermist if we achieve negligible senescence? Will virtue-ethicists too if we can predict how their virtue will develop over time? Do development economists become longtermists if we develop Foundation-style Psychohistory? We don't have a singular term for "not a virtue ethicist" other than "non-virtue ethicist" and there's no commonality amongst nonlongtermists other than being the out-group to longtermists.

Neartermist = explicitly sets a high effective discount rate (either due to uncertainty or a pure rate of time preference) should not include non-consequentialists or people with types of person-affecting views resulting in a low concern for future generations.

On your new document: I think I generally nod along to the peak oil and efficiency stuff. The renewables section is unconvincing, as you might imagine from our discussion above. You are right that there are a bunch of problems with IAMs making simplifications, but you don't demonstrate that any of the factors they are missing would seriously change the results of them. It's good to see that some of your arguments have grown more nuanced, but it also makes reviewing it more complicated and I don't really have the time to debug the report in detail. I'm somewhat (pleasantly?) surprised that at the end of this all you're suggesting that energy depletion might be good for reducing extinction risk though, I don't know to what extent that flips the whole of this conversation - maybe you are actually the optimistic one!

These studies show that mineral requirements for clean energy grow rapidly. But they don't show that the requirements are actually that high in most cases, as they state the ratios "for energy technology". Currently we don't use a lot of minerals in energy provision, so a quadrupling of that amount sounds dramatic but doesn't represent a particularly large global consumption increase. Quote from the IEA: "There is no shortage of resources. Economically viable reserves have been

growing despite continued production growth... However, declining ore quality poses multiple challenges for extraction and

processing costs, emissions and waste volumes." So the problem is still one of energy, rather than actual availability, which is why power is more important than minerals. So really the minerals question is still a renewables question.

Of the minerals shown here to require more than 100% of their current levels in 2050, only lithium would not be fairly easy to replace or produce for a small efficiency penalty (graphite is just carbon, indium is used in solar cells but can be replaced with graphene https://www.azonano.com/article.aspx?ArticleID=3942, cobalt & vanadium are used in batteries and and all have known substitutions). There's some good stuff in this twitter thread, although it doesn't have citations for everything it needs.

The historic examples you give are of the resource curse; societies becoming dependent on extracting commodities. I'm looking for examples of societies falling because they can't buy commodities. E.g. I might have expected the increase in guano price to have created a food shortage and thus civilisational collapse, but as far as I know we didn't see that; similarly, the rise in fertiliser prices you mention don't seem to have had a rise in fascism so far - indeed, the elections so far since the invasion started have gone better for the left than might be expected.

I reiterate that debt economics aren't my field, but I'm skeptical that they provide a barrier comparable to physics. There is clearly a secular trend towards rising debt, but I think you're overestimating it; this IMF graph of global debt-to-gdp only grows at 1%/year from 2000-2018.

I feel like the majority of people I know don't really have personal finance growth as their primary objective in life, and I don't see how our society does either - it's almost an accident of economics at this point.

I hope that virtualisation and renewable power means we can happily all bring on the great stagnation!

Yes, that is the "arguably": do you require agency in your definition of trade, and at what level. There is a mutualistic relationship with the honeybee hives that produce honey and pollinate well, hence their levels are rising during generally declining numbers of other bees. Similarly, we have traded with the genomes of domestic animals, increasing their number, even if the individuals that hold the genes have a worse life because of this trade. There are several stages and timescales to these interactions. The bees trade labor for nectar with the flowers, but the flowers can only establish the deal over evolutionary timescales and rely on bees to have agency in a given lifetime. Similarly we trade our labor and syrup for the bee's honey, but their only alternative is to swarm off/attack and probably the hive will. In my view an exploitative exchange is still a trade.

Agree. We don't trade with ants but we do trade with monkeys, both in experiments https://papers.ssrn.com/sol3/papers.cfm?abstract_id=675503 and when tourists have things stolen https://www.smithsonianmag.com/smart-news/monkeys-bali-swipe-tourists-belongings-and-barter-them-snacks-180963485/. It seems to me that communication is all that is really required. Arguably all domestication is a trade that's become established over evolutionary timeframes. (Domesticated) honey bees are therefore both trading with us and with flowers when they pollinate and produce honey.

I'm sorry your situation has deteriorated from the FTX scandal, that must be very difficult. A lot of people have it much worse than me!

I don't see this as an argument between "everything will turn out fine" and "things will end badly", but "things will go badly for very specific reasons to do with materials accessibility" and "materials accessibility is not the limiting factor". I consider something a lack of imagination where every aspect of the solution exists, but for cost reasons we don't currently combine them in most supply chains. Entirely electrified car factories already exist https://www.hyundai.news/eu/articles/press-releases/gone-green-hyundais-first-factory-powered-by-100-percent-renewable-energy.html. I haven't read Alice Friedmann's book, but her website seems replete with the time-lacking EROI error that we discussed above, as well as an inability to see that our current production chain is not the only way we can go about manufacturing things (for instance, there are plenty of sulfur sources appart from oil, it's just we currently exploit a byproduct of oil manufacture). I think I'm still waiting for historic examples where a material shortage has resulted in anything more than temporary economic slowdown and protests against corrupt regimes. The gilet jaunes protests are the closest I can think of, which hasn't come close to civilisation-threatening. Maybe if there were a clearer pipeline from this to fascism.

Coal is a plentiful resource, and in the worst-case energy crunch, would be used as a substitute for oil and gas. We see some of this happening in electricity in Europe at the moment. You can make a near-kerosene product out of coal, which with some lubricating materials should be adaptable for diesel use in extremis https://www.technologyreview.com/2006/04/19/39349/clean-diesel-from-coal/. This would be environmentally devastating and somewhat expensive, but not really more civilisation-threatening than climate change in general. The general point, that models need to account for a huge range of ways we can substitute one material for another, is the fundamental weakness of this argument.

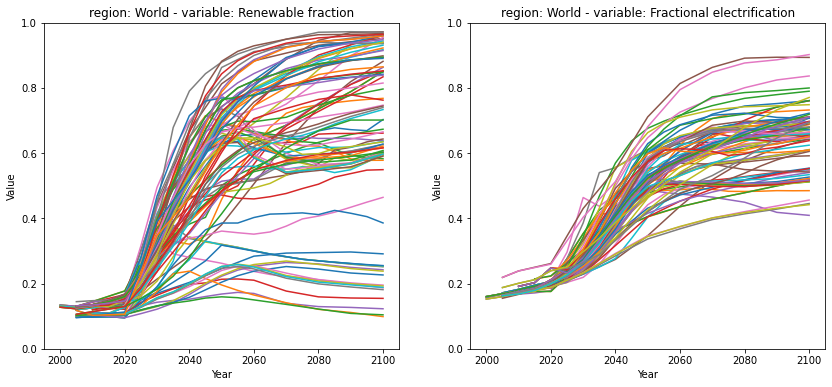

q1) There are an number of studies showing that replacing the a very large fraction of the grid with variable energy is achievable with current technology, some are summarised in this metastudy https://www.nature.com/articles/s41560-020-00695-4. Notably all of these studies suggest a lower cost than the current wholesale cost of electricity in Europe! The pace at which this can be done is a normal subject for the IAMs that you so distrust, which at least in some models is done before 2050, though it's very inconsistent - many scenarios aiming for 1.5C that never reach 70% electrification. They usually reach more than 70% renewable though, soon after 2040. I may have mislead you above with my focus on electrification; several areas of society are projected to remain liquid-based (if biofuel/hydrogen) for some time in a lot of IAMs, though I'm personally skeptical about this. I've plotted the fraction of energy from renewable sources and the fraction of energy use from electricity in the AR6 database of scenarios classified as C1 (low overshoot of 1.5C) below.  The question normally is whether society will accept the costs of bringing about change at the necessary speed, but since in your scenarios the cost of FFs is much higher than most IAMs assume, the answer is basically "yes, though not through free choice". The fact that we restrict FF use because of lack of availability rather than a carbon tax shouldn't make a big difference to the difficulty of decarbonising.

The question normally is whether society will accept the costs of bringing about change at the necessary speed, but since in your scenarios the cost of FFs is much higher than most IAMs assume, the answer is basically "yes, though not through free choice". The fact that we restrict FF use because of lack of availability rather than a carbon tax shouldn't make a big difference to the difficulty of decarbonising.

q2) Yes, I think a lower rate of growth is likely than in an ideal world without material/oil constraints. But it's not clear that growth is negative, nor that slower growth, particularly in developed nations, is that bad. Would high resource costs trigger civilizational collapse? Even with higher fuel prices, the declining fraction of wealth spent on food has a ways to go before we reach anything comparable to, say, the 1950s, so I find it hard to see a mechanism for anything dramatic. While energy is used in making food, it's not the dominant factor, and over long time periods we see the correlation between oil price and food price is not that strong https://ourworldindata.org/food-prices. Economically unfortunate, sure, but not an extinction risk.

Other than specific problems with lithium and copper, it's not clear to me that we have a problem with total material lack, simply that we don't recycle enough or make use of agricultural waste. More effort would go towards plastic recycling if the price point of oil were higher. Similarly there is a plentiful supply of plant-food minerals that are currently pumped from rocks to our faeces to the sea.

Backups to provide food in the event of a protracted energy crash is an interesting question. As above, I don't expect anything like a 1:1 relation from the cost of energy, but in combination with climate variability and geopolitical factors it's possible to envisage a real crunch on availability. I feel like the solutions are very dependent on how long we want to do this for and what fraction of the world needs to be sustained this way. But the discussion of various forms of permaculture and nutrient-recycling, while interesting, should probably be handled elsewhere (and by people who know more about it than I do). Generally, working on better recycling does seem like an under-utilised EA cause area that would solve a number of these problems, and is probably cheaper to begin sooner rather than later. I don't think I need to agree with very many of your above points to agree with this as the process is energy-saving and also protects the environment/enables more agriculture by avoiding mining.

You may be glad to note that on several occasions when writing my responses I have had cause to exclaim "he's less wrong than I thought!" I think this is all anyone can really ask for in an internet argument.

I've been quite stressed, for reasons other than lack of materials! How about you?

I'm not particularly impressed by the podcast. It seems to lack any imagination in working out how to decarbonise the construction of renewable energy itself, which is not generally regarded as a fundamental problem (as opposed to being slightly expensive to transition).

I encountered this twitter thread which I think explains better than I did why EROI isn't that useful: https://mobile.twitter.com/AukeHoekstra/status/1341730308060831744

Exponential energy consumption increase cannot be delivered for long, by any means. But renewable power can easily sustain a doubling of current power consumption.

We have a diesel crunch at the moment in Europe, meaning we are eating into our stockpiles, however all countries still have more than 61 days of consumption or import stockpiled, so considerably more than a week! Some states are less than the 90 days of imports required though. We would see factories shut down due to cost long before we started killing off food transport, so in practice this would last longer.

Agree that the rollout of electric vehicles will be expensive and will take time. But I hope that we will also reduce the number of cars required by carsharing, which autonomous vehicles makes easier. As we transition to renewable power, the prices of fossil fuels stabilises as demand is reduced. This makes greening harder, but diffuses the problem you foresee with food distribution.

5Tb an hour of data doesn't seem like that much, particularly after Moore's law kicks in! A fully renewable grid well realistically require some fossil backup for the next few decades while we get hydrogen sorted. However there price of this should also stabilise, as above.

I guess I'm unclear what the lifeboats you suggest are. I agree that on the margin more people should stockpile food, and possibly more in general. I don't know that it's true that stockpiling, say, copper or lithium is likely to be a wise investment: probably the market is already aware of the needs for these in the future, and to make an appreciable price signal to mine more would be very expensive. There are government stockpiles of quite a few things in developed nations; while developing nations should also stockpile more I am an ideal world, it's not clear how high a priority that is compared to tackling current, definite problems.

Yes, I've also been busy and I think the conversation is getting hard to follow and delivering diminishing returns. But to address a few points:

I think we are mostly in agreement that these scenarios are both bad and plausible, but disagree about the badness and plausibility. However on the second point, the paper you quote is simply not providing enough evidence of its point. Potentially 40 or so years of constant consumption would pass this test, but you should not assume that consumption of energy or resources is constant per GDP, as it simply hasn't been in recent history. The growth in energy consumption the last few decades seems to have been linear rather than exponenetial, but forcing it into exponential form gives an average 1.7% average growth this century https://ourworldindata.org/grapher/global-energy-substitution. Material consumption of, e.g. cement seems to have flatlined recently (as it is mostly done in China), and is also not exponential for any real stretch of time https://www.bbc.com/news/science-environment-46455844.

I don't know very much about supply chain disruption, but I definitely don't feel you've demonstrated that they can persist for many years. There's quite a strong financial incentive to sort them out and most of the disruptions I can think of seem either based on sanctions or to resolve in around a year. I'd be interested to see any historic examples you have. My historic counter-example would be guano, a slowly-renewing natural resource that was required agriculturally and at risk of depletion, but saved by the invention of the Haber process https://www.atlasobscura.com/articles/when-the-western-world-ran-on-guano.

While I agree that France would struggle to go renewable all on its own, I am sure it can go renewable without the aid of any single other continent, given the diverse range of ways of building renewables. I don't really see a situation where Europe would be cut off from all continents even if perhaps a few countries would put up trade barriers. As we see with oil from Russia going to India now, every time you impose a trade barrier, the price of the goods shifts and to tempt other countries to participate in trade.

Analyses of the cost comparison of electric trucks are still crude, but do exist already. The possibly-biased-electric ICCT concludes that in many European cities we may be at price parity (due to existing subsidies) under reasonable assumptions about electricity and diesel prices https://theicct.org/wp-content/uploads/2022/06/tco-battery-diesel-delivery-trucks-jun2022.pdf. While battery swapping isn't yet a thing, it probably will be soon for large trucking firms, which eliminates the charging problem. I don't understand why the lidar data needs to be stored, most of the work can be done locally and you can overwrite it minute-by-minute, can't you?

I don't really know what to think about this banking problem, it feels like it can be treaded as a separate issue to the materials problem in a digital economy though.

I think the result shows the Cherp paper is over-keen to lock in often temporary bottlenecks. This doesn't mean that growth will never slow, but casts significant doubt on our ability to predict it. It's worth separating out actual generation (weather-dependent) from capacity with wind, which has still risen by 2.5% for the last two years https://www.statista.com/statistics/421797/tracking-wind-power-in-germany/. That isn't great but is hardly stagnation! Solar has been doing better and it looks like it will be up more this year https://www.pv-magazine.com/2022/08/01/germany-deployed-3-2-gw-of-pv-in-first-half-of-2022/.

I think the emerging technologies (electric trucks etc) have extremely high (but variable) growth rates because they have such low current penetration. But the combination means that we can't estimate the long-term trends very well. Cherp's technique, quite wisely, doesn't even try.

I fundamentally don't think that the energy economics of a solarpunk post-scarcity future will necessarily have much in common with pre-agrarian society. We are not primarily talking about the EROI of food production here, which would dominate this consideration.

We do indeed agree on your final points. I definitely don't look towards a business-as-usual future! More work developing other futures is very valuable. I just think it's important to be clear when you're discussing a worst-case scenario verses a likely scenario, and to realise that society has a lot of self-repair mechanisms that toy models miss out.

Three scenarios where we do not make a green transition:

Firstly, we are structurally prevented by government forces, for instance, in many countries there is difficulty in obtaining planning permission to get renewables in place, or have perverse tax incentives (gas cheaper than electricity for instance) that make the transition difficult. Both of these are currently happening in the UK, but not enough to resist the pull of renewables completely!

Secondly, energy demand takes off so quickly (perhaps due to AI) that we expand green power without reducing FF, until the sort of problem you indicate occurs.

Third, something disrupts the global supply chain that renewables currently depend on.

However all of these seem likely to be self-limiting because if the situation really got that pressing, you'd assume governments and society would adapt to fix them unless there's a bad actor or civilizational collapse.

- International trade between allies does very well in a war though, and even enemies keep trading through many wars. I'm not entirely sure who the enemy is in this case.

- Currently true, but the more true it is, the stronger the incentive will be to switch over quickly when oil prices rise. I anticipate a very quick switchover because it looks like the advent of affordable electric trucks will align closely with (and usually combines with) the advent of driverless technology, meaning the two biggest costs of trucking can be slashed simultaneously by changing over

- Oh right - yes, this is because production can be freely moved within reason. Basically we're not yet in the regime where oil is being treated as a scarce resource. We may indeed regret this in centuries to come, though I suspect we'll find replacements.

- The big legislation is the Besel III rules, which have been continuously strengthened since the crash, regulating the fraction of money banks need to hold in different forms. It's not perfect (some people think the classification of money doesn't really match the risks) but it's definitely tighter than it was https://www.federalreserve.gov/publications/2020-may-supervision-and-regulation-report-banking-system-conditions.htm

There are also lots of stress-tests carried out on institutions to see if they'd collapse in particular circumstances, which should account for inter-departmental ignorance in banks. I haven't read that book though and can't comment in detail. - There clearly are limits to the extent of renewable deployment, but I'm unconvinced that they have been seen so far. Halstead is inaccurately reading Cherp et al 2021, since he restricts his analyses to only the solar PV data for only the subset of samples that are classified into these three categories. The study analyses 60 countries and fails to classify the majority of them for either solar or onshore wind. In addition to the 5 accelerating PV countries there are 6 different countries accelerating onshore wind. The table remarks that 4 stable onshore wind countries have substantial offshore wind, but does not investigate this in detail.

In criticism of the study itself, the three “poster-child” countries with stalling renewable energy deployment in 2019 all showed a notable deployment in the supposedly stalled renewable energy by 2021. (New Zealand onshore wind: 2.26 -> 2.64 TWh; Spain solar 15.1 -> 26.8 TWh – an 80% increase in 2 years; Germany solar: 44.9 ->49.0 TWh, OurWorldInData). This happened during COVID, and against the long-term trend of these countries reducing overall electricity usage. When deployment becomes variable, for sociopolitical or megaproject reasons, the sigmoid function assumed in this study only allows for negative temporary deviation from exponential growth and assumes that any deviation is locked in indefinitely. In reality, laws restricting e.g. onshore wind can disappear, returning us to an exponential growth phase.

Yes, I agree there are practical problems with basing society on 1.1 EROI solar cells. A lot of this discussion is really "how can we work out the actual EROI from the quoted EROI only looking at a bit of the system". Infrastructural costs should definitely be included in these analyses, however I think they're also quite hard to estimate because you need to know how long your infrastructure will last both from degradation and from being made irrelevant.

Thanks!

This article isn't an exclusive list of the countries that celebrate it, merely a list of how it's celebrated in 11 noteworthy nations. It's also celebrated in Iran, China, Germany...